Understanding the Role of a Financial Analyst

A financial analyst has a crucial role in the world of finance. They are responsible for assessing the financial performance of companies and providing recommendations to help inform investment decisions. This involves conducting thorough research, analyzing financial statements and market trends, and interpreting complex financial data. Financial analysts play a vital part in assisting individuals and organizations in making informed decisions that can have a significant impact on their financial well-being.

In addition to financial analysis, a financial analyst is also involved in forecasting and budgeting activities. By utilizing their analytical skills, they help companies develop realistic financial projections and create effective budgets. This enables organizations to plan and allocate resources efficiently, facilitating growth, and ensuring financial stability. Overall, financial analysts are integral in providing valuable insights and expertise to aid businesses and individuals in navigating the complex and ever-changing landscape of finance.

Required Education and Skills for a Financial Analyst

A career as a financial analyst requires a solid educational background and specific skills to excel in the field. Most employers typically require candidates to have at least a bachelor’s degree in finance, accounting, economics, or a related field. However, some companies may prefer candidates who have a master’s degree in a relevant discipline, particularly for more senior or specialized positions. A strong understanding of financial principles, as well as knowledge of financial analysis techniques and tools, is crucial for success in this role.

In addition to formal education, financial analysts need to possess a range of skills to effectively perform their responsibilities. Strong analytical and quantitative skills are essential, as analysts are required to analyze complex financial data and make informed recommendations. Attention to detail and the ability to work with precision are also crucial, as financial analysis often involves scrutinizing intricate financial information. Additionally, financial analysts should have excellent communication and presentation skills to effectively communicate their findings and recommendations to clients or senior management. Proficiency in financial software and a strong command of spreadsheet applications are also highly valued skills in this profession.

Industries and Sectors Hiring Financial Analysts

The demand for financial analysts spans across various industries and sectors, as these professionals play a crucial role in analyzing and interpreting complex financial data. One sector that extensively hires financial analysts is the banking and financial services industry. In this sector, financial analysts are necessary to evaluate investments, assess risks, and provide recommendations to management. Additionally, they work closely with banking institutions to identify market trends, make informed decisions, and develop financial strategies. Another industry that often requires the expertise of financial analysts is the healthcare sector. Here, financial analysts are responsible for monitoring the financial performance of healthcare organizations, analyzing costs, and identifying opportunities for cost-saving initiatives. They are vital in ensuring the financial stability and efficient operational management of healthcare facilities.

Furthermore, the technology industry is another sector that heavily relies on financial analysts. In this dynamic and rapidly evolving field, financial analysts are instrumental in evaluating investment opportunities, analyzing revenue growth, and assessing the financial viability of potential technology ventures. They provide valuable insights on market trends, conduct industry research, and help technology companies make informed financial decisions. The manufacturing industry is also a significant employer of financial analysts. In this sector, financial analysts are responsible for budgeting, cost analysis, and financial forecasting. Their expertise enables manufacturing companies to optimize operations, make data-driven decisions, and allocate resources effectively.

Job Responsibilities of a Financial Analyst

A financial analyst plays a crucial role in a company’s financial decision-making process. Their primary responsibility is to analyze financial data and information to provide insights and recommendations to the management team. This involves conducting in-depth research, evaluating market trends, and assessing financial reports to identify potential risks and opportunities. Additionally, financial analysts are responsible for developing financial models and forecasts to support strategic planning and budgeting initiatives. They collaborate with other departments to gather relevant data and ensure accurate and timely reporting.

In addition to financial analysis, a financial analyst is often involved in project valuation and investment analysis. They assess the feasibility and profitability of various investment opportunities, such as acquisitions, expansion projects, or market investments. This requires them to conduct thorough due diligence, including financial risk assessment, market research, and industry analysis. Financial analysts also play a vital role in mergers and acquisitions, where they evaluate the financial implications of potential deals and provide insights on valuation and negotiation strategies. Overall, a financial analyst’s responsibilities encompass a wide range of tasks, all aimed at providing accurate and actionable financial insights to drive informed decision-making.

Factors Affecting Financial Analyst Salaries

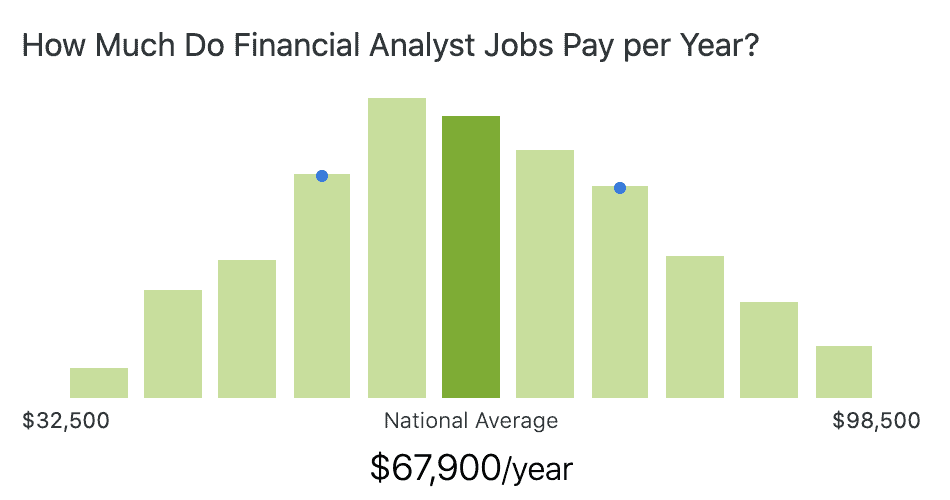

When it comes to financial analyst salaries, there are several factors that can influence the earning potential of professionals in this field. One key factor is the level of experience and expertise that a financial analyst brings to the table. Generally, those with more years of experience and a strong track record of success in their field can command higher salaries.

Another factor that can affect financial analyst salaries is the location of the job. Different regions and cities may have different cost of living expenses, which can impact the salary range for financial analysts. For example, financial analysts working in major cities like New York or London may earn higher salaries compared to those working in smaller towns or rural areas.

Additionally, the industry or sector in which a financial analyst works can also impact their salary. Certain industries, such as investment banking or private equity, tend to offer higher salaries for financial analysts due to the complexity and high stakes involved in their work. On the other hand, industries such as non-profit organizations or government agencies may offer lower salaries in comparison.

Career Progression and Advancement Opportunities for Financial Analysts

Career progression and advancement opportunities for financial analysts are abundant, making this field an attractive choice for individuals seeking growth and development in their careers. As financial analysts gain experience and demonstrate their expertise, they have the opportunity to take on more challenging roles and responsibilities within their organizations. This can include moving up the hierarchy to become senior financial analysts, where they may oversee a team and be responsible for larger and more complex projects.

Another avenue for career progression is the opportunity to specialize in a specific area of finance. Financial analysts can focus on areas such as investment analysis, risk management, or corporate finance, among others. By specializing, analysts can become subject matter experts in their chosen area and improve their career prospects. Additionally, gaining advanced certifications such as the Chartered Financial Analyst (CFA) designation can open doors to higher-level positions and increase earning potential for financial analysts.

Benefits and Perks of Being a Financial Analyst

Financial analysts enjoy a range of benefits and perks that make their profession quite appealing. Firstly, one of the main advantages of being a financial analyst is the competitive compensation package. Financial analysts tend to receive attractive salaries, along with potential performance bonuses and profit sharing opportunities. This aspect not only reflects their skillset and expertise but also acknowledges the valuable contribution they make to the financial success of organizations.

Additionally, financial analysts often have access to comprehensive employee benefits packages. These packages may include health insurance, retirement plans, and paid time off. These benefits provide financial security and peace of mind, allowing financial analysts to focus on their work without worrying about their well-being or future. Moreover, some companies may offer additional perks such as flexible work schedules, remote work options, and professional development opportunities. These additional benefits help create a positive work-life balance and support the growth and advancement of financial analysts in their careers.

Job Outlook for Financial Analysts

The job outlook for financial analysts continues to show promising growth. With the increasing complexity of financial markets and the need for expert advice and analysis, the demand for skilled financial analysts is expected to remain strong. This is particularly true in industries such as investment banking, asset management, and consulting.

In addition to the overall growth in the field, the job outlook for financial analysts can also be influenced by factors such as economic conditions, technological advancements, and regulatory changes. For example, during periods of economic downturns, companies may rely on financial analysts to navigate through financial challenges and make informed decisions. Similarly, advancements in technology, such as automation and artificial intelligence, can affect the demand for financial analysts as their roles evolve to incorporate new technologies. Keeping up with these trends and continuously updating skills and knowledge can be essential for financial analysts to maintain a competitive edge in the job market.

Tips for Negotiating a Higher Financial Analyst Salary

When it comes to negotiating a higher salary as a financial analyst, there are a few key tips to keep in mind. First, it’s important to do your research and have a clear understanding of the salary range for your position and experience level within the industry. This will not only give you a baseline to work from, but it will also allow you to provide specific information and examples during your negotiation.

In addition to research, it’s crucial to highlight your accomplishments and the value you bring to the company. Be prepared to discuss specific projects or deals that you’ve contributed to and the positive impact they had on the organization’s financial performance. This will help to justify your request for a higher salary and show that you are a valuable asset to the company. Finally, be confident and assertive during the negotiation process. Clearly communicate your expectations and be willing to negotiate and compromise, but also know your worth and don’t settle for less than what you deserve.

Resources for Finding Financial Analyst Job Opportunities

When it comes to finding job opportunities as a financial analyst, there are various resources available to assist you in your search. One of the most common and effective ways is to utilize online job boards and career websites. Platforms such as Indeed, LinkedIn, and Glassdoor offer a wide range of job listings specifically tailored to the financial analyst field. These websites allow you to search for positions based on location, industry, experience level, and other relevant criteria. Additionally, many companies also have their own career portals on their websites, where they post job openings directly. It is advisable to frequently check these portals for any new opportunities that may arise.

Networking can also be an invaluable resource for finding financial analyst job opportunities. By attending industry events, seminars, and conferences, you can connect with professionals in the field and potentially learn about unadvertised job openings. Additionally, joining professional associations and organizations related to finance and accounting can provide you with access to exclusive job boards and networking events. Remember to take advantage of social media platforms like LinkedIn and Twitter, where you can connect with fellow professionals and join relevant groups or communities. Building a strong professional network can not only help you find job leads but also provide valuable insights and advice throughout your career.

What is the role of a financial analyst?

The role of a financial analyst is to analyze financial data, prepare financial reports, and provide recommendations to help businesses make informed decisions about their investments and financial strategies.

What education and skills are required to become a financial analyst?

Most financial analyst positions require a bachelor’s degree in finance, accounting, economics, or a related field. Strong analytical skills, attention to detail, and proficiency in financial analysis software are also essential.

Which industries and sectors typically hire financial analysts?

Financial analysts are in demand across various industries and sectors, including banking, investment firms, insurance companies, consulting agencies, and corporate finance departments.

What are the job responsibilities of a financial analyst?

The job responsibilities of a financial analyst include conducting financial research, analyzing investment opportunities, preparing financial forecasts and reports, monitoring financial performance, and providing recommendations for improvement.

What factors can affect financial analyst salaries?

Several factors can affect financial analyst salaries, including experience level, education, industry, company size, geographic location, and job performance.

What are the career advancement opportunities for financial analysts?

Financial analysts can advance their careers by gaining experience, earning professional certifications (such as the Chartered Financial Analyst designation), and taking on managerial or senior-level roles within their organizations.

What are the benefits and perks of being a financial analyst?

Benefits and perks of being a financial analyst may include competitive salaries, bonuses, healthcare benefits, retirement plans, flexible work arrangements, and opportunities for professional development.

What is the job outlook for financial analysts?

The job outlook for financial analysts is projected to grow at a faster-than-average rate, driven by the increasing complexity of financial markets and the need for businesses to make strategic financial decisions.

What tips can help in negotiating a higher financial analyst salary?

Some tips for negotiating a higher financial analyst salary include researching industry salary trends, highlighting your qualifications and achievements, demonstrating your value to the employer, and being prepared to negotiate.

Where can I find financial analyst job opportunities?

You can find financial analyst job opportunities through various resources such as online job boards, company websites, professional networking platforms, recruitment agencies, and career fairs.